** Disclaimer when submitting a Tax claim for a calendar year, you will only receive a Refund/ Money if you have overpaid tax in that calendar year. If you have underpaid tax, you could potentially owe money. (Generally, this won’t happen, or if it does the sum of money should be small. **

*This is advice and not instruction it is documented with the intent to help people understand more about the process. Individuals are responsible for completing their own tax reviews. *

You will need to ensure your employer has completed your P60 before you go through this process. (Well ideally you should, it’s harder to complete if this hasn’t been done.)

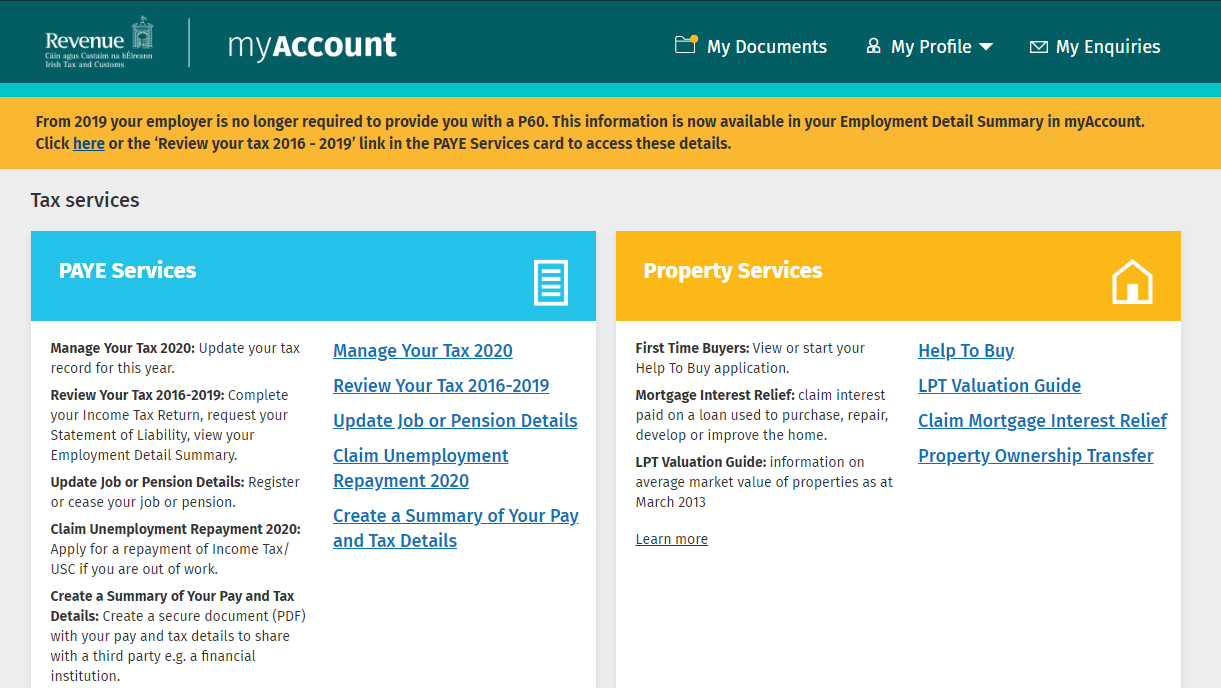

Once logged in, you will see the below screen:

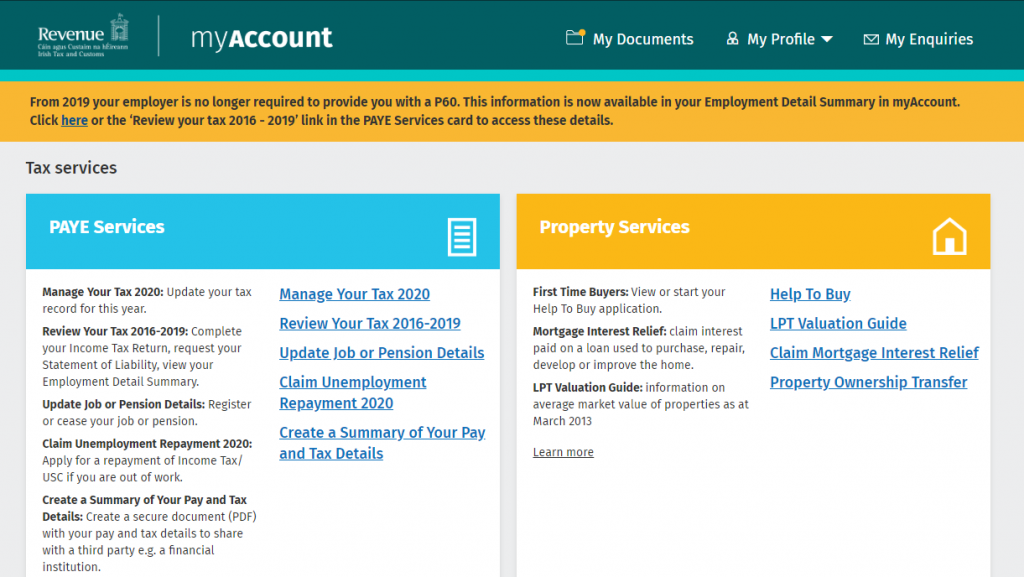

To commence this click Review your Tax 2016-2019:

Click to submit an Income Tax Return

Enter/ Confirm your Personal Details

Review you PAYE Income for the calendar year. (This should be populated already from the P60 which your employer has completed.)

Declare your Non-PAYE Income. To explain what this includes it is essentially income you have received that wasn’t from working in a job you are paid through payroll.

Confirm/ Submit your Tax Credits/ Tax Reliefs.

Your tax credits should already be applied, and the Tax reliefs contain a list of prepopulated options.

One which may be of particular use is your medical expenses. If you have had medical expenses throughout the year you can submit these. Do not falsely declare expenses, you may be asked to provide proof of these expenses.

Lastly you must declare that all of the information you have submitted is truthful. Essentially that you have submitted the information honestly and not attempted to understate income and overstate expenses with the intent of benefiting financially.

The process is actually quite simple provided you have the appropriate information they request. Please let us know if this advice was helpful or if there is any information missing.